SYDNEY, Today: Nielsen’s 2025 ad spend snapshot puts Harvey Norman at the top of Australia’s advertiser rankings, with retail and big consumer brands again filling most Top 20 spots as competition for attention ramped up across a fast-changing media landscape.

Spending clustered around categories where Australians are reassessing costs, especially finance and insurance, while retail stayed the market’s heavyweight. Travel and accommodation also lifted as airlines, hotels, tourism bodies and booking platforms pushed harder to stay front-of-mind.

Rose Lopreiato, Nielsen Ad Intel’s Australia Commercial Lead said, “More than ever, where you spend matters as much as how much you spend.

“With retail still dominating overall investment and faster growth coming through finance, insurance and travel, advertisers need a clear view of the battlegrounds, both the categories pulling the most dollars and the brands increasing pressure.

“Independent measurement like Ad Intel helps marketers pinpoint the moments and sectors where competitors are most active, so they can invest with confidence, defend share, and avoid being outgunned in the categories where customers are actively shopping around.”

Fresh entrants reshaped the 2025 leaderboard, including Westpac, Big W, Stan Entertainment, Budget Direct, Nestle Australia, Allianz, KIA and QANTAS.

“With retail still dominating overall investment and faster growth coming through finance, insurance and travel, advertisers need a clear view of the battlegrounds, both the categories pulling the most dollars and the brands increasing pressure..”

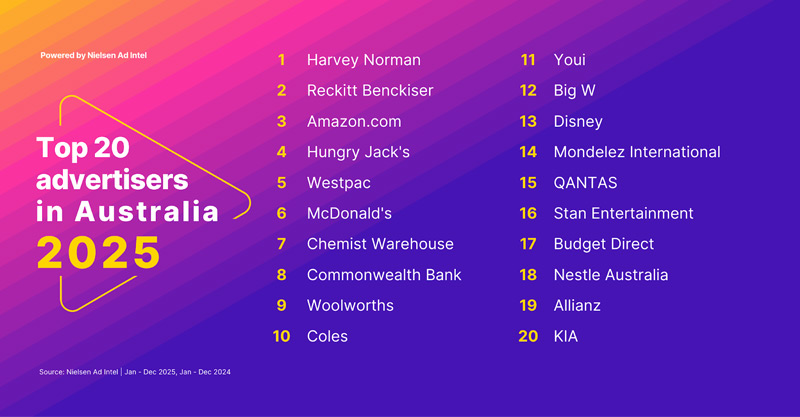

Australia’s Top 20 advertisers for 2025

- Harvey Norman, 2. Reckitt Benckiser, 3. Amazon.com, 4. Hungry Jack’s, 5. Westpac, 6. McDonald’s, 7. Chemist Warehouse, 8. Commonwealth Bank, 9. Woolworths, 10. Coles, 11. Youi, 12. Big W, 13. Disney, 14. Mondelez International, 15. QANTAS, 16. Stan Entertainment, 17. Budget Direct, 18. Nestle Australia, 19. Allianz, 20. KIA

Year-on-year movement was strongest across finance and insurance. Westpac debuted at number five, Commonwealth Bank jumped from 12th to eighth, Budget Direct and Allianz entered the Top 20, and Youi climbed from 17th to 11th.

Retail remained the dominant category, drawing $2.312 billion. Finance followed with $756 million, then Travel & Accommodation at $684 million, highlighting intense competition around major household decisions and discretionary spending.

Top 20 ad categories by investment in 2025

- Retail: $2.312b, 2. Finance: $756m, 3. Travel & Accommodation: $684m, 4. Communications: $656m, 5. Motor Vehicles: $646m, 6. Entertainment & Leisure: $549m, 7. Insurance: $493m, 8. Food: $407m, 9. Services: $368m, 10. Computers: $348m, 11. Education & Learning: $302m, 12. Real Estate: $265m, 13. Community & Public Service: $264m, 14. Pharmaceutical: $230m, 15. Government: $224m, 16. Appliances (Home & Outdoor): $207m, 17. Clothing & Accessories: $172m, 18. Gambling: $171m, 19. Media: $152m, 20. Toiletries & Cosmetics: $152m

Even with ongoing economic pressure, the spread across all 20 categories shows brands still prioritised advertising to protect share and maintain presence.

Finance delivered the biggest lift, up $123.3 million (+19.5%), while Insurance rose $57.2 million (+13.1%).

Travel & Accommodation gained $76.5 million (+12.6%), signalling strong demand but tougher booking battles. Computers also grew $52.4 million (+17.7%), alongside Services, up $40.1 million (+12.2%).

Share this Post