AUCKLAND, Today: The NZ advertising market’s Covid downturn is officially over,” according to SMI, which is reporting April ad demand soaring a record 56.2% year-on-year to $78.9 million, bringing the total just 2.7% shy of the April 2019 pre-pandemic result.

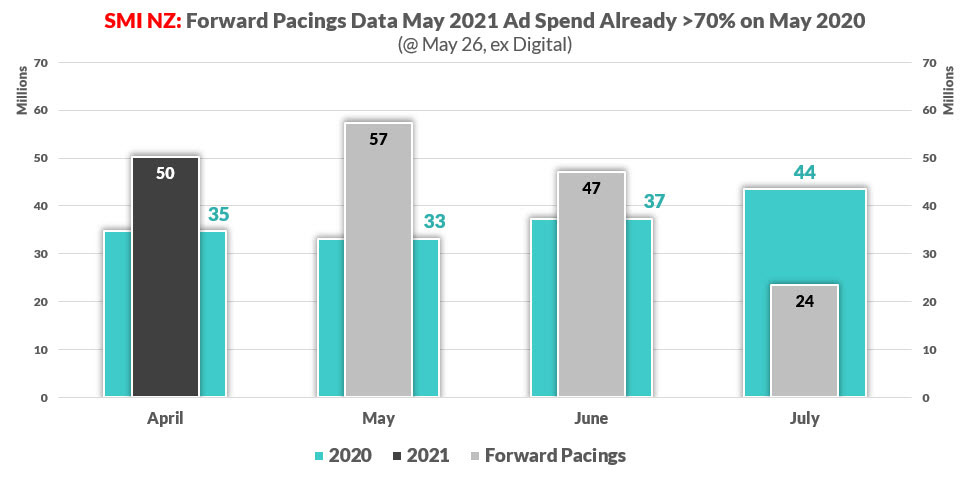

SMI AU/NZ MD Jane Ractliffe said: “The recovery will improve even further with SMI’s forward bookings data showing the level of growth in advertising demand in May is already stronger than that recorded for April, with the total up 72.8% [ex-digital media].

“It’s quite an incredible turnaround as we’re only a month into the second quarter and SMI’s data is already reporting market demand up 46.7% – or $49.5 million – above what was achieved for the whole Q2 pandemic-affected 2020 period.

“I’ve said before the growth rates we’ll be seeing in future months will be mindboggling and that’s certainly proving to be the case as in May we can already see Outdoor adspend is up 156% on May 2020, while bookings to Magazines are up 157% and Cinema adspend for May is already 50% higher.

“The individual media growth rates now being reported in April were also extraordinary, with Cinema adspend leading the market with a year-on-year percentage growth rate of 132.1%, followed by the larger Outdoor media which more than doubled ad bookings.

“We’re in unchartered territory – we’ve never before seen such levels of meteoric growth in NZ.”

“Elsewhere Digital adspend grew an incredible 81.2%, TV bookings soared 42.2%, Magazine adspend lifted 26.8% and Radio bookings jumped 20%.

“New Zealand’s advertising market is in unchartered territory as we’ve never before seen such levels of meteoric growth.

“We all know these huge gains are coming from a very low base but even so it’s hugely encouraging to see advertising revenues flow strongly across our major media after such a prolonged period of reduced advertising demand.

“New Zealand’s April result is stronger than what SMI is reporting in most other sophisticated media markets, with growth in Australia seen at 39.7%, US ad growth hitting 43.2% and UK ad demand lower again at 24%.

“However, the strongest growth was reported in Canada where ad demand soared 74.9% in April as the Canadian ad market was the worst affected by Covid last year.

“NZ’s April result is stronger than what SMI is reporting in most other sophisticated media markets.”

“At a product category level there were a number of NZ product categories that showed exceptional growth with many exceeding their April 2019 spend levels.

“For example, the Restaurants category grew adspend by 328% in April; specialty retailers increased ad investment by 291.7% and the toiletries/cosmetics market doubled its media investment.

“The recent return to confidence has resulted in a 14.6% increase in national marketer ad spend for the four months of this calendar year, with the total now up 4.8% on the same pre- Covid period in 2019.

“And financial year-to-date results show agency spend is now just $107,534 below the same period last year, ensuring a positive financial year result once the higher May and June data is added.

“Given the NZ media market has suffered through the toughest financial year in its history the fact we will report higher ad demand for the financial year is simply incredible.,” Ractliffe said.

“It’s a huge testament to the resilience of the industry that it has been able to manage through such a monumental decline in the ad revenues that supports us and to come out the other end in reasonable shape.”

- More here: www.standardmediaindex.com

Share this Post