Graham Christie, the CCO/partner of Auckland-based APAC-wide mobile marketing outfit Big Mobile Group has released the company’s latest Mobile Hub report – containing in-depth and insightful analyses with a focus on internet trends, mobile scale, live video, China’s mobile revolution.

Internet Trends 2015

Kliener Perkins and their taliswoman Mark Meeker, released their annual report recently, and I’m sure you will have read synopses here and there regarding the near 200 pages.

Mobile now has the majority share (51%) of all digital time spent, out of interest it was (12%) in the age of iPhone 1.

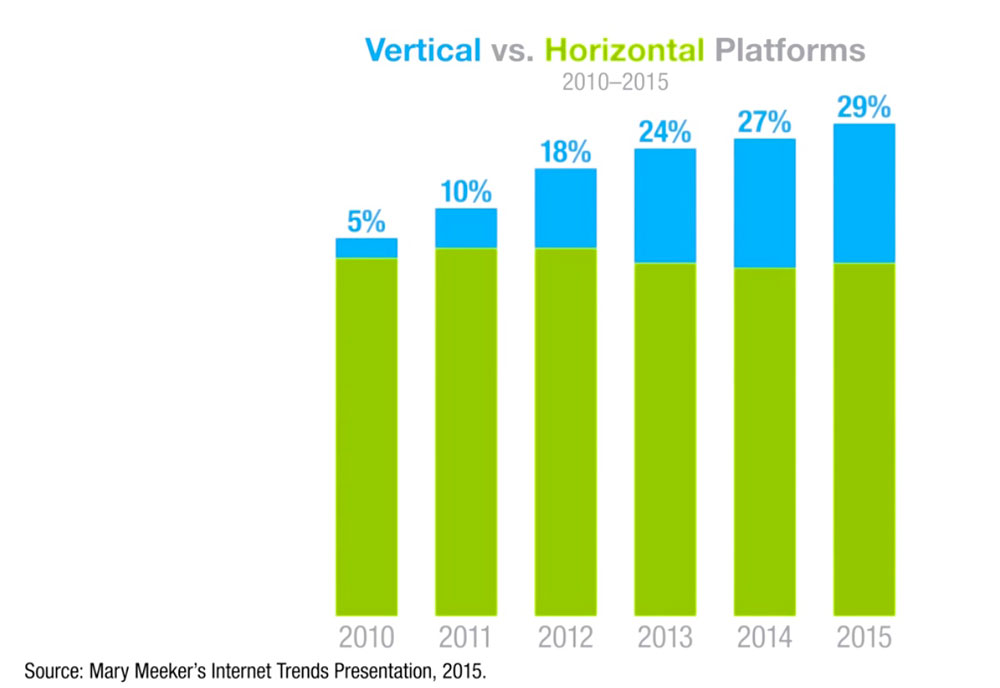

In terms of new news, the report, using eMarketer data, highlights the interesting phenomenon of mobile video viewership in the vertical (not landscape) orientation. Nearly a third of the time (29%), users watch video vertically – that’s up 5% from 2010.

I’m reminded – it must be said, gleefully, by a senior TV/video executive – of David Lynch the Hollywood director’s apoplectic take a few years back on watching films on an iPhone. He was incredulous then; heaven only knows what he would make of vertical video watching!

Anyway, it’s worth bearing in mind if you’re producing branded video content, the evidence is clear, on the Snapchat platform at least, that completion rates are 9x higher on video ads watched vertically than those watched horizontally. The report is easily accessed and worth a read and feels nothing like 200 pages, the information is so succinctly put.

Mobile scale

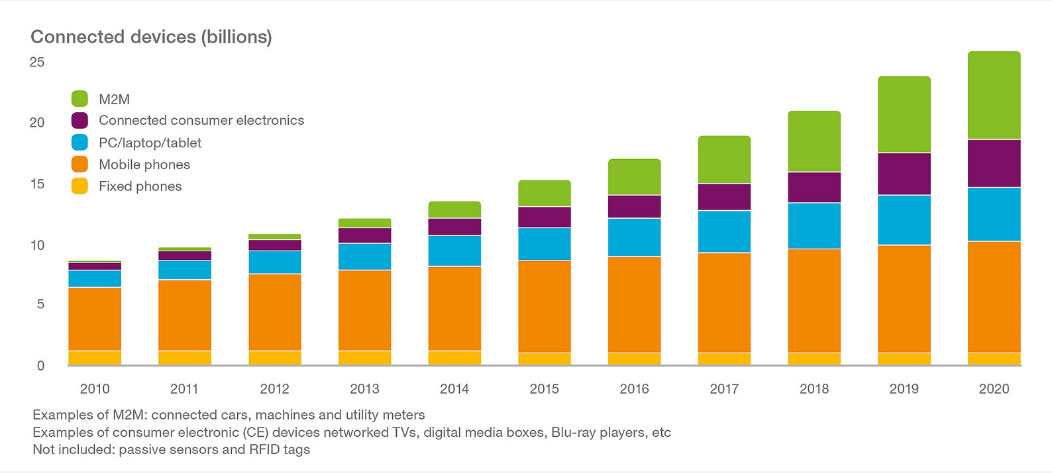

Ericsson has released its Mobility Report stating that 70% of everybody, everywhere will have a smartphone by 2020, with the real momentum taking place in APAC, the region reaching 2 billion smartphone users. Include all handset types across the world and mobile’s reach surpasses 9 billion, and furthermore wearables and all other internet connected ‘things’ will reach 26 billion.

Ericsson originally tabled the figure of 50 billion IoT devices, but have sharpened their forecasting to get to a nonetheless still very significant number.

The impact of this will see worldwide smartphone data usage increase fivefold. A lot of that will be mobile video that is forecasted to grow 55% yoy up to 2020, and will then gobble up a 60% share of all mobile data.

This places a bit of a conundrum on network roll-outs, and the timeframe on 5G. The thing is, 4G only accounts for 5 per cent of the world’s mobile connections, with 70% in South Korea, 50% in Japan, and 40% in the US. But it seems there’s a way to go until the ceiling is reached.

Apparently Turkey is making noises that it may skip 4G, and move to 5G – that’s bold, expensive, and a bit daft.

Live video

Periscope and Meerkat apps have become the new antagonists of traditional and sub-tv sector. Consumers in their droves were able to view the Pacquiao-Mayweather fight without ordering it, and in another example, streams of the new season of Game Of Thrones were very popular.

It’s difficult to imagine the mass market putting up with a motion sickness experience, however it’s another example of mobile disruption. The acceptance of seeing high quality long form content albeit by the minority, is a positive for brands looking at live streaming of probably shorter form content for audience segments.

China’s mobile revolution

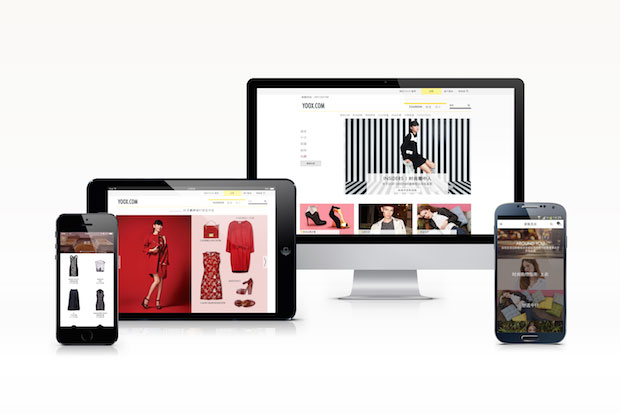

China’s adoption of e-commerce over mobile continues apace, fuelled as it is by Alibaba’s Tmall, and WeChat, with newer entrants like Yoox and Majujie fanning the flames. Majujie is a rising star with observers crediting its popularity with ‘Pintrest like’ functionality, curation and sharing.

In China, sales over mobile are at parity with those on desktop, and according to iResearch, the Jan-March 2015 Qtr delivered 168% yoy growth in mobile sales, worth an eye-watering US$58 billion. This has premium and luxury good sectors clambering to develop or upgrade their mobile app with a fuller e-commerce UX and capabilities.

Facebook’s Instant Articles

With predictions such as 80% of all internet traffic on mobile by 2019, it’s bleedin’ obvious that if you’re a publisher, it’s mobile or go home. And more so, that getting into bed more with the dominant mobile platform that is Facebook, becomes tempting.

But FB’s Instant Articles has publishers in at least two minds. The choice as I see it depends on the publisher’s specific situation, whether they are managing legacy models (and if they are doing so too passively or aggressively), their NPD capabilities, sales team calibre, and capital reserves.

It’s unorthodox to allow a separate entity to dictate ad product (therefore ad revenue), around one’s own content, but tapping more seamlessly into a huge audience base is attractive.

The possibility of the goalpost moving in the future, and the net effect of over-reliance on a big behemoth worries many. And this at such a pivotal time when publishers must be focused on the qualities of control and differentiation, make a decision tricky. In the end though I think it’s one based essentially on whether tactical or strategic objectives are uppermost.

Marin Software

Marin published their Mobile Advertising Around the Globe Annual Report across markets including Australia, India, New Zealand, and Singapore. Given their focus, they have an interest in understanding relationships across channels. By the end of 2016 they expect mobile to have outpaced desktop, and tablet for click engagement.

There’s evidence still that the mobile and tablet is used more for upper funnel activities such as researching purchases, with consumers converting/transacting on desktop. Display saw the most drastic mobile growth of all three channels. Mobile click share for display grew almost 60% from January to December 2014, starting at 32% and ending at over 50% of click share, making mobile devices the majority of all display ad clicks by end of 2014.

Marin concludes the report with 6 best practices for marketers:

- Play to each channel’s and device’s strengths.

- Correctly attribute mobile conversions.

- Optimise ads for mobile experience.

- Target consumers across devices and channels.

- Invest in mobile app advertising.

- Plan ahead for mobile video advertising.

Share this Post