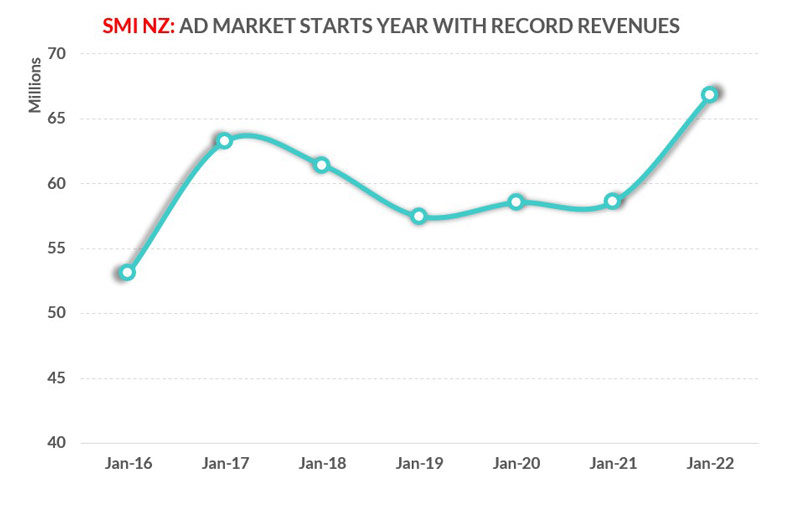

SYDNEY, Wednesday: The NZ media agency market started the new 2022 year strongly, reports (global number-cruncher) Standard Media Index, delivering a record level of adspend for January up 14% to $NZ3 million – more than the previous January high, set in 2017.

SMI AU/NZ MD Jane Ractliffe said: “The SMI results highlight the evolving advertising market as television bookings fell 2.1% while digital revenues again soared – this time by 18.6% – and within that digital video revenues jumped 60% year-on-year.

“The results are a further testament to the strength of the New Zealand advertising economy as it continues to move well past the covid era.

“The value of New Zealand’s advertising market in January is not only well above pre-covid levels but also 5.6% above the last record level of January adspend set in 2017, which underscores the strength of the ad demand we’re currently experiencing.

Radio, cinema, outdoor up

“Across other media, radio also delivered healthy growth of 18.9% and the outdoor media’s recovery stepped up another notch despite the ongoing lockdowns with revenue growth of 38.9%.

“Similarly, cinema’s recovery continued with its spend up 74.3%.

“The growth in Government category adspend is underpinning the market.”

“The top three spending product categories all showed double-digit gains, led by Government which was up 65.6% to $10 million. Retail advertising lifted a healthy 40.5% to $6.8 million and specialty retailers gained 22.8% to $6.3 million.

“Among key product categories, the headline news was the emergence of the Government category as the market’s largest in January after lifting the value of its media investment by 66% year-on-year as they continued messaging in response to the pandemic.

Downside

“However, the SMI data showed the current level of ad demand was being fuelled by a concentrated number of product categories, with a third of the major categories reporting lower adspend than in January 2019.

“The growth in Government category adspend is underpinning the market, but there are many large categories which are spending less now than in January 2019 with key examples being banks, toiletries/cosmetics and communications.

“Media companies need to be well across these changing trends to maximise revenues during this high-growth period.”

About Standard Media Index

SMI was established in 2009 in Sydney and has offices in New York, London and Madrid. SMI partners with leading global media buying agencies to provide independent and timely advertising expenditure data to its clients. Data is sourced directly from ad agencies’ billing systems and aggregated to show the combined picture of media agency adspend across all major media, media sectors, 41 product categories and more than 145 sub-categories. SMI works with media agencies in 15 global markets.

Share this Post