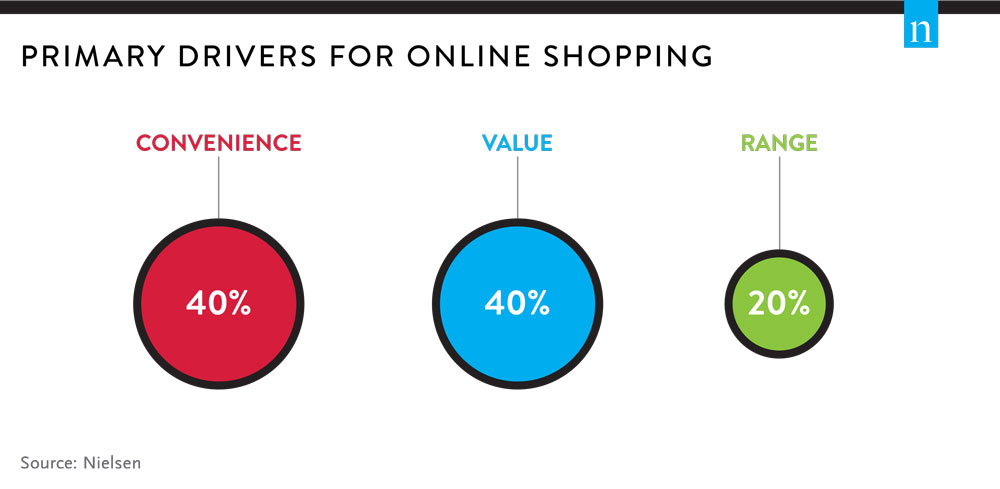

New research from Nielsen reveals a 40:40:20 rule at play behind nearly 2 million (1,952,000) New Zealanders who are shopping online. The primary drivers of e-commerce are comprised of 40% convenience, 40% price & value, and 20% range.

Convenience is important – saving time and effort with retailers at consumers’ fingertips. Forty percent of online shoppers cite saving time or effort as their main reason for shopping on the internet.

Mobile devices are paving the way for consumers to shop online at different locations, it is convenient and immediate. Nearly a quarter (23%) of online shoppers buy via smartphones while nearly one-in-five (19%) do the same on their tablet.

Price competition and value for money is another key driver as stated by 40% of online shoppers; consumers everywhere want a good product at a good price.

“E-retailers have an advantage where they can pass real estate cost savings onto their customers to undercut the bricks and mortar businesses,” says Nielsen NZ research director Tony Boyte. “Additionally digital can be used as a promotional tool to sell excess stock without wasting prime shelf space.”

The ability to buy unique items, or to source items either not available in local stores, is also a draw to the online retail space. Twenty percent primarily shop online because of the range available including items they want that not available in the local area.

“The seemingly limitless options available in a virtual environment provide new opportunities for both merchants and consumers” Boyte says.

New retail habits

The report reveals that retail is converging and online browsing converts to both online and in-store purchasing. Show-rooming does occur, with 57% of online shoppers having looked at a product in-store and then bought online (often to secure a cheaper price), yet only 5% do this regularly. “On the other hand, we now see New Zealanders web-rooming,” says Boyte. More than eight in 10 (84%) online New Zealanders have been prompted to go in-store to purchase an item following browsing online.

“Now is the time to create omni-channel experiences for consumers who are actively using both digital and physical platforms to research and purchase, as increasingly, they don’t make a distinction between the two,” Boyte says.

About the Nielsen Online Retail Report 2015

Nielsen’s Online Retail Report provides in-depth information on the nation’s online retailing. It is an annual measure of e-commerce activity and shopping patterns. The research methodology combines an online panel survey of 1100 New Zealanders with Nielsen’s Consumer & Media Insights service and Nielsen Online Ratings. The report is now available to purchase.

Share this Post