Graham Christie, the CCO/partner of Auckland-based APAC-wide mobile marketing company Big Mobile Group, has released the company’s latest Mobile Hub report – containing analyses of the figures that frame 2016 and beyond for mobile across APAC:

Firstly the top five global mobile ad markets will remain the same: US, China, UK, Japan, and Germany.

The next few following is where things change, with Australia in 2016 becoming the 7th largest market globally, surpassing South Korea.

Worldwide in 2016 the Mobile Ad market will exceed US$100 billion, accounting for 51% of the digital market. Yes, 51%. This is a 430% increase on 2013 levels. Very notably, the forecasts for 2018 show Indonesia will make the largest gain out of all 22 rankings, rising from No 21 in 2015 to No 12 and a value of US$1.4 billion. This values the market bigger than Italy, Russia, Mexico, Spain, and India. (Source: eMarketer).

In a recent Economist Intelligence Unit publication (The Rise Of The Marketer), the speed of growth of mobile is highlighted. Comparing ANZ and APAC with the rest of the world, the future trend that will have the biggest impact for CMOs by 2020 in ANZ is real-time mobile personalised transactions (65%), but across APAC as a whole it is the Internet Of Things (54%).

Wearable technology comes in third place across all geo-segments (average 32%). (Source: EIU)

Mobile Payments reache maturity in 2018

Talking of wearables, Gartner has released a report (2016 – Know Your Customers to Capture Opportunities in the Personal Technologies Market) stating payments via smartphones and smartwatches are to hit 50% in advanced markets (like Japan) by 2018.

Given the good deal of overall fragmentation in the NFC space, plus the embryonic stage of – for example – Android Pay, Gartner suggests that cloud-based payments services will instead fuel the growth through less vertically aligned (closed) models, and a wider range of use-cases beyond the classic store based interaction.

Mobile Share

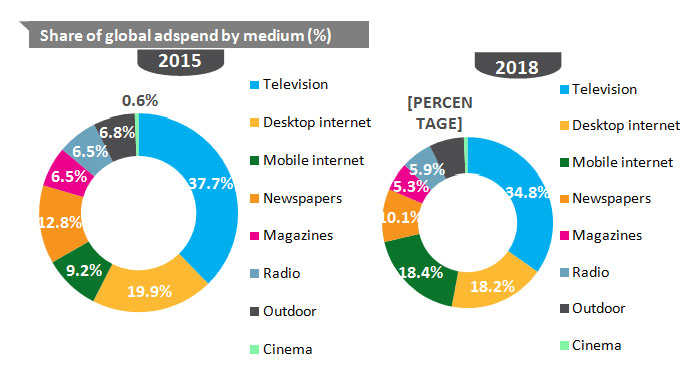

ZenithOptimedia released a global forecast just before the end of the year that shows percentage of adspend by medium 2015 vs. 2018. Quite a short window admittedly, but clear themes tabled with TV, desktop, Newpapers, Magazines, Radio, and OOH all decreasing, but Mobile doubling. I think the desktop percentage still seems a little too buoyant however, this may the burgeoning video space and way data is counted.

The problem with Mobile’s adolescence

So although there’s runaway growth there is the vital task of making mobile more mature and measurably productive. Similar, really, to developing an adolescent into an adult human being.

Bear with me on this. In an excellent book that is essential reading for parents, titled Adolescence by Michael Carr-Gregg and Erin Shale, the tricky period in a younger person’s life, and the impact of those around them, is scrutinised in an attempt to make more sense of it all. Here are some of the chapter headings in the book: ‘Am I normal?’ ‘Who am I?’ and ‘What Is My Place In The World?

Rings any bells? These are exactly the sorts of sober questions marketers are asking of ‘mobile’ as they look further into 2016 and beyond. It’s abundantly clear that mobile isn’t a normal marketing channel – not just a younger media channel sibling, nor is its ‘place’ defined, as it’s a work-in-progress and, it has to be said, remains extremely over-stimulated.

Time then for all to act like a VC

So that’s the tension. On one hand, standards and norms need to be established to help mobile scale efficiently, but on the other, there’s a need to leverage mobile more holistically and certainly more innovatively, which will inevitably encourage straying from proven pathways.

Of course, it’s not an either/or, but a necessity to do both, and here’s a way I think more marketers should orientate themselves to take advantage of mobile better in 2016. Pretend you’re a VC. Both scale up investments in the proven areas and in the proven ways that make sense, but also look to invest in and cultivate a medium and long term customer asset through innovation, and ‘figuring it out’.

Speculate, try and fail, iterate.

Mobile is a sure thing, we all know this, but the irony is, some organisations are risking significant failure in the medium and long term by exhibiting too much hesitancy in the immediate term. Importantly, these marketers also need to set a framework assisting their agency partners to recommend mobile strategies and tactics with the same speculative VC type mindset.

I agree with Julie Ask of Forrester, where in her blog she says: “In 2016, the gap between customer-obsessed leaders who will embrace mobile as a means to create new value, and laggards who consider mobile to be a stand-alone channel will widen.”

Share this Post