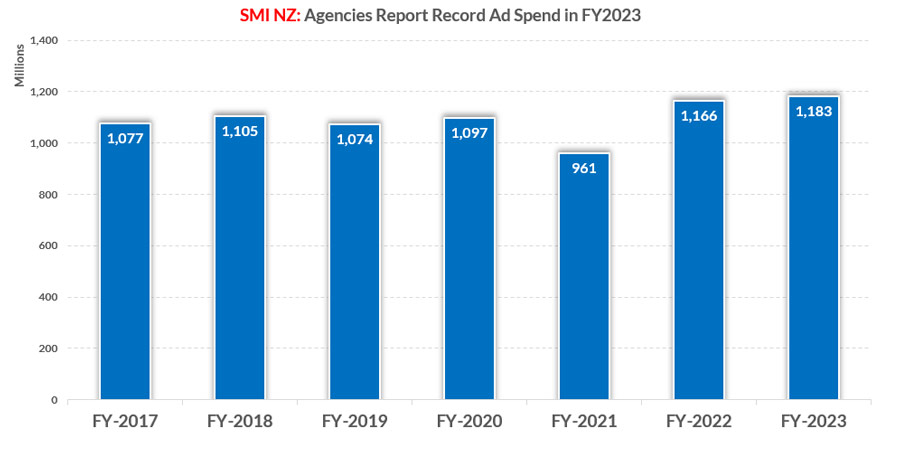

AUCKLAND, Today: New Zealand’s ad market has shrugged off a sharp retraction in Government category adspend post-covid to deliver a record level of adspend this financial year, with the total up 1.4% to $1.17 billlion.

That was despite the market reporting another month of lower adspend in March against the record March 2022 period, with total bookings back 8.6%.

But that decline was again mostly due to a significant fall in adspend from the largest category of Government (-25% YOY in March) and when that is removed the underlying decline in NZ ad spend reduces to – 6.2%.

In the March quarter, total bookings are back 7.2% but that’s also compared against a record level of ad spend in the March 2022 quarter.

SMI AU/NZ MD Jane Ractliffe said: “The return of Government category adspend to pre-covid levels was abnormally impacting the market across all time frames.

“Government adspend necessarily increased significantly during the covid period given the amount of specific messaging required.

“But as it’s no longer needed we’re seeing a super sharp decline in Government ad spend which over the course of this financial year is down by 18% and that represents a loss of more than $26 million in ad revenue.

“Government adspend necessarily increased significantly during the covid period given the amount of specific messaging required.”

“And so when we remove Government category adspend from the financial year total, the underlying market growth over the 12 months is actually an impressive 4.2%.”

“The lower March demand affected all the largest media, with linear TV ad spend back 16% and Outdoor revenues fell 4.7% but Digital did well to minimise its decline to 0.7% as Social Media ad spend bucked the downward trend with revenue growth of 8.7%.

“But the smaller media of Magazines and Cinema continued to grow with their bookings up by 3% and 86.9% respectively.

“For the financial year, Digital media revenues lifted 10.7% and Outdoor and Cinema both continued their covid recovery, up 7% and 62.6% respectively.

“And while Government reported the largest decline in demand among all the categories, across the year the Restaurant category delivered the largest growth (+25.2%), followed by the categories of Utilities/Fuel/ Energy (+24.2%), and Cosmetics/Toiletries (+17%).

About Standard Media Index

Standard Media Index was established in 2009 in Sydney and has offices in New York, London and Madrid. SMI partners with leading global media buying agencies to provide independent, accurate and timely advertising expenditure data to its clients to facilitate informed analysis of the media sector and product category expenditure. Data is sourced directly from advertising agencies’ billing systems and then aggregated to show the combined picture of media Agency adspend across all major media, media sectors, 30 product categories and 100 sub categories.

Its NZ data covers 95% of all Agency spend and SMI works with media agencies in 15 global markets.

Share this Post